aurora sales tax rate 2021

Just tap to find the rate Local sales use tax. Ad Find Out Sales Tax Rates For Free.

Property Tax Village Of Carol Stream Il

For more information regarding sales tax or to apply for a sales tax license please visit the Colorado Department of Revenues website.

. Residential Property Tax Rate for Aurora from 2018 to 2021. The average sales tax rate in Colorado is 6078. The Aurora Sales Tax is collected by the merchant on all qualifying sales.

The following list of Ohio post offices shows the total county and transit authority sales tax rates in most municipalities. Download our Tax Rate Lookup App to find Washington sales tax rates on the go wherever your business takes you. Download all Illinois sales tax rates by zip code.

Effective January 1 2022 increase of 5 for Measure 2F for the Monument Police Department. The Aurora Illinois sales tax is 625 the same as the Illinois state sales tax. In general the tax does not apply to sales of services except for those services specifically taxed by law.

4 Sales tax on food liquor for immediate consumption. The December 2020 total local sales tax rate was also 8000. 5 Food for home consumption.

STATE OF OHIO. 2 Rate includes 05 Mass Transit System MTS in Eagle and Pitkin Counties and 075 in Summit County. ENTITY STATE RTD CD COUNTY CITYTOWN TOTAL.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora. You can find more tax rates and allowances for Aurora and Illinois in the 2022 Illinois Tax Tables.

Monthly if taxable sales are 96000 or more per year if the tax is more than 300 per month. This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing. Our mobile app makes it easy to find the tax rate for your current location.

Aurora in Illinois has a tax rate of 825 for 2022 this includes the Illinois Sales Tax Rate of 625 and Local Sales Tax Rates in Aurora totaling 2. The current total local sales tax rate in Aurora CO is 8000. Note that failure to collect the sales tax does not remove the retailers responsibility for payment.

The current total local sales tax rate in aurora co is 8000. The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

The minimum combined 2022 sales tax rate for Aurora Colorado is. You can print a 825 sales tax table here. Look up a tax rate on the go.

Sales tax change from 3 to 35. Method to calculate Austin sales tax in 2021. 2021 final property tax bills.

There is no applicable county tax. This is the total of state county and city sales tax rates. Annually if taxable sales are 4800 or less per year if the tax is less than 15 per month.

Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. 1 Reduced collection of sales tax from certain businesses in the area subject to a Public Improvement Fee. The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc.

DEPARTMENT OF TAXATION. 2021COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY. Informational Bulletin - Sales Tax Rate Change Summary FY 2022-08 2 Sales Tax Rate Changes for Sales of General Merchandise Jurisdiction Combined rate ending December 31 2021 Rate Change NEW Combined rate beginning January 1 2022 Type of Local Tax Change Municipalities Addison 800 025 825 Home Rule Arcola Downtown and I-57 Business District.

Colorado Sales Tax 1 Revised August 2021 Colorado imposes sales tax on retail sales of tangible personal property. Method to calculate Huerfano County sales tax in 2021. Year Municipal Rate Educational Rate Final Tax Rate.

The Aurora sales tax rate is. Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month. The 825 sales tax rate in Aurora consists of 625 Illinois state sales tax 125 Aurora tax and 075 Special tax.

The average sales tax rate in Arkansas is 8551. The County sales tax rate is. The Colorado Department of Revenue is responsible for publishing the.

The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special tax. The 2018 united states supreme court decision in south dakota v. The estimated 2021 sales tax rate for 80016 is.

The Colorado State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Colorado State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. For tax rates in other cities see Colorado sales taxes by city and county. However in the case of a mixed transaction that.

3 Cap of 200 per month on service fee. COLUMBUS OH 43216-0530. Download the latest list of location codes and tax rates.

PAGE 1 REVISED January 1 2021. There is no applicable county tax. With CD 290 000 010 025 375.

31 rows colorado co sales tax rates by city. The Arkansas sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. Fast Easy Tax Solutions.

While many other states allow counties and other localities to collect a local option sales tax Illinois does not permit local sales taxes to be collected. The state sales tax rate in. You can print a 85 sales tax table here.

The Colorado sales tax rate is currently. Aurora-RTD 290 100 010 025 375.

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Aurora Kane County Illinois Sales Tax Rate

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

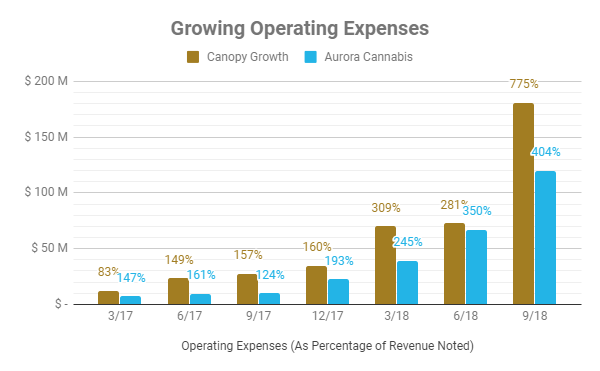

Aurora Cannabis Announces Fiscal 2022 Second Quarter Results

Aurora Cannabis The Good The Bad And The Ugly Nasdaq Acb Seeking Alpha

Could Aurora Cannabis Be A Millionaire Maker Stock The Motley Fool

How Colorado Taxes Work Auto Dealers Dealr Tax

Aurora Colorado Sales Tax Rate Sales Taxes By City

Ontario Cannabis Store Report Shows Aurora Leading Flower Sales Covid 19 Sales Boost

Curtis Gardner Curtisforaurora Twitter

Uxbridge Property Tax 2021 Calculator Rates Wowa Ca

Illinois Car Sales Tax Countryside Autobarn Volkswagen

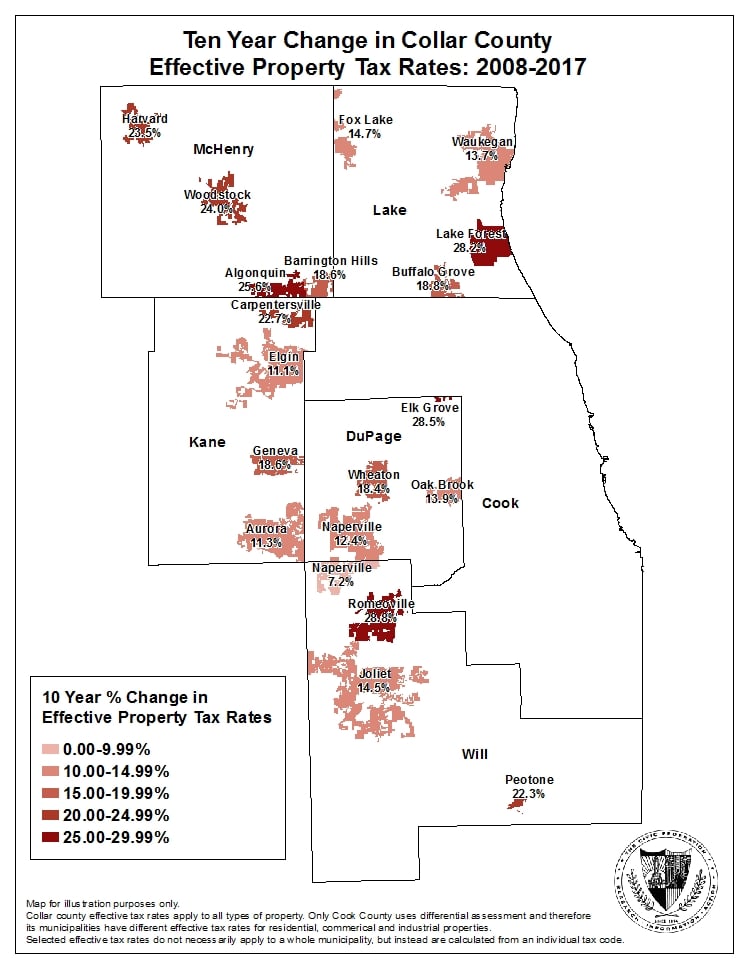

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

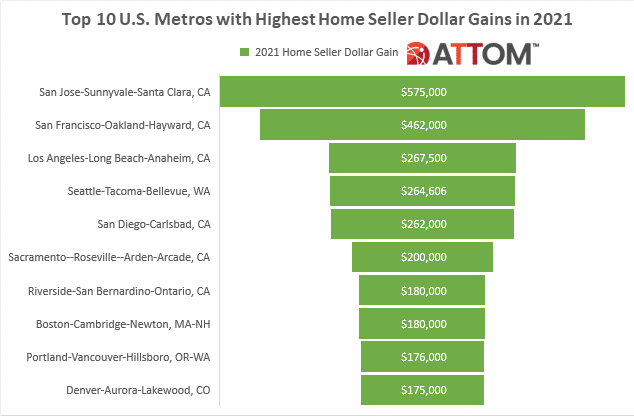

Top 10 U S Metros With Highest Home Seller Profits In 2021 Attom

Ic Ikki68 Aurora R2 Gb Starts In Less Than 2 Days Gb Prices Vendors Build Stream Tonight R Mechmarket

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute